Woodhouse Colliery. The Great Carbon Carbuncle?

Ciara Shannon considers some of the carbon risks if Woodhouse Colliery were to go ahead and highlights some alternative opportunities. She ends by thinking about the area's sizeable, historical carbon debt.

Ciara Shannon considers some of the carbon risks if Woodhouse Colliery were to go ahead and highlights some alternative opportunities. She ends by thinking about the area's sizeable, historical carbon debt.

When I think of the word carbuncle I think of inflamed, pus-filled boils, but the word originally comes from carbunculus - which is Latin for ‘coal’ and is also another name for a deep red gemstone.

Like with gems, not all coal is equal. Thermal coal is used for electricity generation, while metallurgical coal is used almost exclusively by steelmakers as a ‘reducing agent’ to purify iron ore and convert it into iron needed for steel making in the blast furnace process.

Typically, metallurgical coal has more carbon, less ash and less moisture than thermal coal. Coking coal is a subset of metallurgical coal and is converted to coke by driving off impurities to leave almost pure carbon.

Given our insatiable appetite for steel and the superior carbon quality of metallurgical coal, perhaps then, it is indeed the ‘great carbon carbuncle’.

If Woodhouse Colliery is approved, the £160m metallurgical coal mine in Whitehaven is expected to increase UK emissions by 0.4Mt CO2e per year. This is greater than the level of annual emissions the Climate Change Committee (CCC) has projected from all open UK coal mines to 2050.

On top of the mine's own operational emissions, the mine will produce 2.78 Mt of metallurgical coal per annum or a total of 65 Mt over its lifetime. The coal's end-use emissions (Scope 3) when at peak production will be between 8.79 - 8.957 Mt of CO2e per year (and this number considers BEIS's conversion factors (that change annually). ( And I've rounded this number up later to 9 Mt CO2e).

While there is still approval from the Marine Management Organisation (MMO) to come - if the mine gets the green light, it could take at least 2 years before production could begin [and then it will take a few years until full production starts (c 2029)]. But for ease of math, let’s say a start date of 2025 to 2049 (24 years) of 9 Mt C02e each year = this would mean West Cumbria Mining's (WCM) coal would be responsible for about 216 Mt CO2e.

To put this in perspective, emissions for the whole of Cumbria were 3.8 Mt C02e in 2019 (BEIS, 2019).

For Copeland, the borough of the mine, the Connected Places Catapult Net Zero Navigator Tool estimates total emissions in Copeland in 2018 of 656Kt CO2e using the SCATTER Cities methodology. Sellafield's emissions are the dominant source of emissions – procurement of goods and services, gas and electricity usage come to an overall combined footprint of around 280 KtCO2e per year in 2019/2020].

Planning Ping Pong

The mine first secured planning approval from Cumbria County Council (CCC) in March 2019 - ironically, around the same time, the UK parliament set in law net zero emissions by 2050. Since then, the mine has been approved several more times, the last time in October 2020 – but in February 2021, the Council halted its decision, and the plans were called in for a Planning Inquiry.

The Inspector has now made his recommendation to the Secretary of State for Levelling Up, Housing and Communities Michael Gove, and rumour has it he is supportive of the mine. But it’s not clear if the ‘rumour’ was ‘dropped’ to influence the local elections in Copeland (who generally support the mine for the 532 jobs it will create ) or if it was political kite flying. Gove has until July 7th to decide.

This is not the first time this controversial project has gone to this office, nor likely the last.

I‘ve already mentioned the importance of the 500 or so jobs (of which 80% would be filled locally) that the mine will bring. But another key reason that the Government is likely interested in this project as highlighted by the CEO of the mine, Mark Kirkbride in his Proof of evidence - is their projected steady revenue of more than £264 million annually, making a £1.5 billion contribution to UK GDP and providing £2.4 billion worth of exports in the first 10 years of operation. Over 20 years of operation - a GDP boost of more than £5 billion in exports (which is around 1.8% of the balance of trade deficit). Together, so says WCM, with tax payments into the UK Treasury of more than £800 million over the life of the mine.

Do these numbers stack up? No. Two years ago, Duncan Pollard and I questioned WCM's business case, outlining instead that the Colliery risks becoming a stranded asset, as the use of coking coal in steel making will be displaced by greener steel methods way before the mine's end date of 2049. If the mine is approved, any economic benefits in terms of regional revitalisation and jobs will be short-lived.

It is also important to highlight, that the UK’s biggest imports and exports by weight are fossil fuels, as highlighted in Green House Think Tank's report ‘Trade and Investment Requirements for a Zero Carbon Economy’.

Replacing Russian Coke? No Case for the Coal Mine

In 2020, British Steel stated to Cumbria Council that “Sulphur is a constraining factor which currently limits the use of the coal.” The amount of sulphur is important, as blast furnaces have operating licences that limit the sulphur content of their input coal, or of their emissions output in order to prevent acid rain.

Until recently, WCM has said that their coal would replace US HVA coal, and 85% of WCM’s coking coal would be exported to the EU, not least because of the high sulphur content which is too high for the UK market.[ii] The rest of their coking coal is for domestic use, for which, according to the Climate Change Committee (CCC), if the UK is to meet its net zero timetable, steel firms must stop burning coking coal by 2035. Unless they fit expensive technology such as Carbon Capture and Storage (CCS) and bury them underground.[iii]

Over the last two months, Russia's invasion of Ukraine has renewed calls to support the Cumbria mine, by some, as the UK sources 39% of its coking coal from Russia. Approving the mine, so say its supporters, would "help slash the need to import foreign coal".

However, others see this as a trojan horse [v]. Industry expert, Chris McDonald who chairs the UK Metals Council recently said “I think it’s important to be clear that even if this mine opened tomorrow, it would not displace a single tonne of Russian coking coal from the UK. Tata Steel already does not use any Russian coking coal. Tata Steel has said if the WCM coal were available, then they may or may not use a small amount and British Steel has said they can’t use the coal from Cumbria [because of the sulphur levels]. So, there’s no possibility that it can displace any Russian imports”. [vi]

If this is the case, and to borrow a thought from the UN Secretary-General, it seems to be true that fossil fuel interests are now cynically using the war in Ukraine to try to lock in a high carbon future.

Mr McDonald went on to say that big players in the European steel industry have plans to reduce their reliance on coking coal from 2030 onwards. This means the mine is unlikely to have a long life. Former CEO of British Steel, Antonius Ron Deelen also said that British Steel has been investigating the future and coal is not part of it. EAF and scrap are.

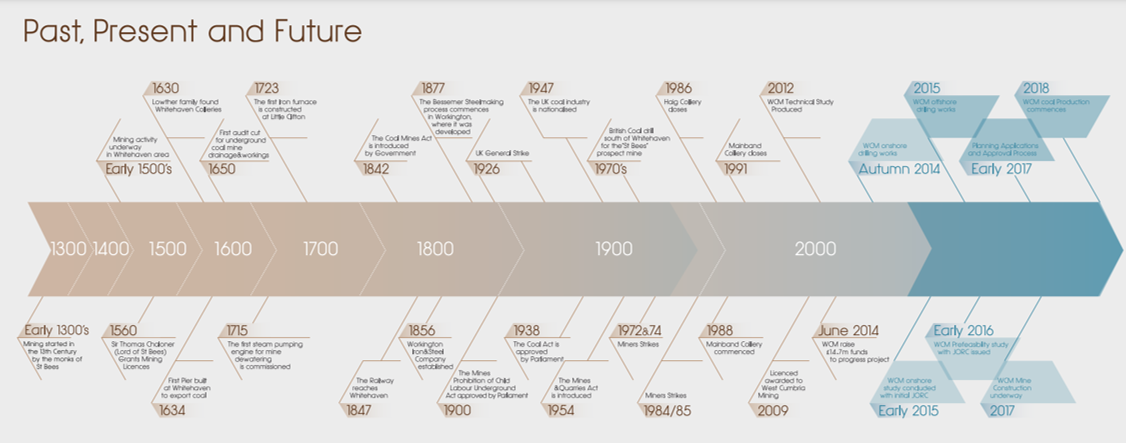

Perhaps then, WCM has missed the boat on the market. Whitehaven would, once again, become a stranded fossil fuel community, as it did following the loss of coal and steel in the 1980s, on which it thrived. It is the 'just transition' in reverse. Miners would become skilled in metallurgical coal - but only for a short amount of time. And then what do they do? How then do they earn their livelihood?

Understanding More About Steel

Steel is one of the most polluting industrial materials in the world after cement, responsible for almost 7-9% of global greenhouse gas emissions (GHGs), most of which arise because of the use of coking coal in blast furnaces during steelmaking rather than downstream manufacturing.

Producing 1 tonne of steel with traditional methods releases almost 2 tonnes of CO2 into the atmosphere, and the world uses almost 2 billion tonnes of steel each year.

The UK manufactures a relatively small amount of steel, – 7 million tonnes of steel (2019) and most UK-made steel is manufactured in blast furnaces in Port Talbot in Wales and Scunthorpe in Yorkshire. However, it could be likely that prolonged high energy costs could see these plants significantly reduce production.

Decarbonising Steel

There are several ways to reduce emissions from steel production. From reusing and remanufacturing steel, recycling steel in electric arc furnaces (EAFs), the direct reduced iron process (DRI) using natural gas, and potentially hydrogen (H2-DRI) and using less steel.

The relatively low price of blast furnace steel production has stymied the scale-up of these alternatives. Green steel is currently more expensive than conventional steel, but the cost of producing hydrogen with electrolysers is falling fast and renewable energy is getting cheaper.

So far, the Government has established a £250m clean steel fund to reduce steel-making’s carbon impacts, including the shift away from coal, but the UK is yet to pilot clean steel technologies, nor has it set a policy framework. A decision by the Government to renew the UK’s steel installations is fast approaching, and it is not yet clear which technology they will adopt. For example, the blast furnace (no 5) in Port Talbot reaches the end of its life around 2025 and needs replacing (not with another blast furnace), having already had work done on it in 2018/19 to extend its life by 5 to 7 years.

Scrap Steel. The UK Should Not Waste This Opportunity

Recycling steel - unlike other materials, scrap metal is infinitely recyclable. In the short term, steel scrap can be melted down to make new steel in EAFs which are much more energy-efficient than blast furnaces and can be powered with zero-carbon electricity from renewables.

However, while EAFs do not require coal, a small number of facilities still need pig iron to blend with scrap and other feedstock materials, which usually require coking coal. Recycled steel also doesn’t work for certain high-grade applications, and more significantly, there’s not enough of it to keep pace with demand.

The UK generates about 10 million tonnes of scrap a year - Celsa Steel in Cardiff and Liberty Specialty Steels in Rotherham are two of the largest recycling steel plants in the UK. And yet not much of it stays here. We export 80% of our scrap to countries such as India, Turkey, Pakistan and Egypt.

Direct Reduced Iron (DRI)

Another promising technology is the reduction of iron ore such as Direct Reduced Iron (DRI). DRI typically uses either “natural gas” instead of coal, or syngas from coal, as a reducing agent. When natural gas is used, steel-making can potentially halve the emissions of using coal.

The big buzz though is with hydrogen-based DRI and leading the way on this are trials by SSAB who are collaborating with LKAB and Vattenfall on the “HYBRIT system”. In fact, SSAB recently announced that they aim to be the first steel company in the world to bring fossil-free steel to the market in 2026 and largely eliminate emissions from its own operations in around 2030.

Hot on their heels is ArcelorMittal which has just successfully tested the use of green hydrogen to reduce iron ore at one of its industrial sites in Canada, in what the world’s second-largest steelmaker claims is a milestone for the industry. They are also investing ~ €1bn in green steel projects in northern Spain, with support from the Spanish government. Also worth mentioning is ThyssenKrupp Steel in Germany which also intends to use hydrogen and aims to be climate neutral by 2045, with an earlier target of reducing emissions by 30% by 2030.

Hydrogen is already playing an increasingly important role in the energy transition and it goes without saying a move to hydrogen will place downward pressure on demand and prices for metallurgical coal.

Yet the UK is lagging behind on this and it needs to accelerate the development of hydrogen based steel. With more government support, this could well be the boost the UK steel industry needs which has been in decline for some time for reasons such as high business rates and energy costs which have drained the industry's capacity to invest in alternatives. Other factors which have played against them are cheaper products and excess steel capacity which has outstripped demand for many years, driven largely by China. And more recently that British steel companies will face a 25% tariff on exports to the US.

Timeline For Producing Green Steel At Scale

But for how long will the world need coking coal for steel making?

This is an important question and central to the debate over the proposed mine in Cumbria. WCM forecasts a sustained and long-term demand for coking coal until [at least] 2050. The UK Steel’s director-general has said that decarbonising steel production will be very difficult to do by 2035 since production methods are not yet available at a commercial scale.

Meanwhile, 'green' steel by 2030 was a key target that emerged from COP26 and the aim for steel in the Glasgow Breakthrough was to make ‘Near-zero emission steel’ the preferred choice in global markets, with efficient and near-zero emission production in every region by 2030 or earlier. Noting, ‘Near-zero emissions’ steel is yet to be defined but is likely referring to a greater than 90% reduction versus the conventional BF-BOF route, though both ore and scrap-based routes will be part of the solution

The steel industry across Europe is already moving to low carbon production steel-making, which inevitably will cut demand for WCM's coal and those European steel mills are still operating coal-fed blast furnaces from 2030 to 2035+ will suffer increasing costs of carbon because free ETS allowances for EU steel producers will be phased out from 2026 to 2035.

The UK Industrial Decarbonisation Strategy, released in March 2021, targets a nearly fully decarbonised steel sector by 2035, based on recommendations from the UK CCC.

Develop and Invest in a Hydrogen Strategy for Cumbria and the North West of England

Steel’s future has tremendous implications for hydrogen, and it is encouraging that the UK Government is set to double its 2030 hydrogen production target to 10GW and will provide £375 million to boost green hydrogen production capacity. Just last week, both the BEIS Net Zero Hydrogen Fund (Strands 1 &2 that equals £240m) and the Industrial Hydrogen Accelerator (IHA) Program were launched.

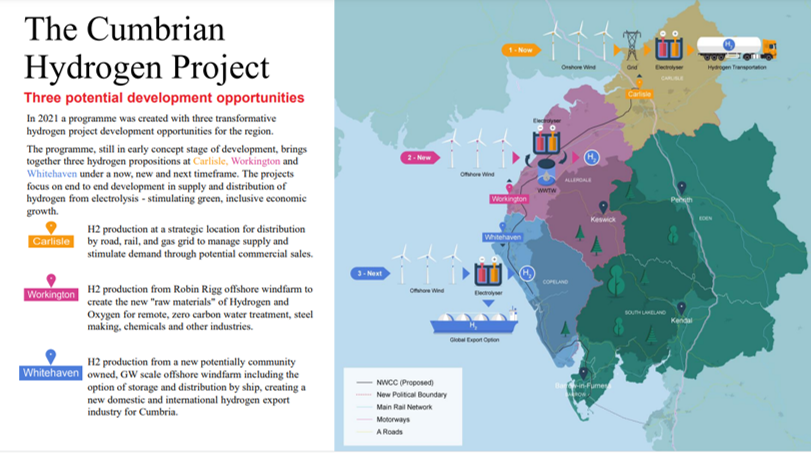

A Three-Pronged Hydrogen Approach for Cumbria. The Opportunities of Hydrogen

West Cumbria (soon to be part of Cumberland as of April 2023) has an extraordinary opportunity to be at the forefront of the green hydrogen revolution using its abundance of offshore wind to produce green hydrogen.

Already in development is a three-pronged hydrogen project for Cumbria that is being led by Arup, with the support of the Cumbria LEP and a consortium of interested parties. While still in the early concept stage, the hydrogen propositions would be at Carlisle, Workington and Whitehaven and are defined by a "now, new and next" timeframe.

The project focuses on end-to-end development in the supply and distribution of hydrogen from electrolysis and is underpinned by stimulating green, inclusive economic growth opportunities. See more here in Cumbria's Green Investment Report (pg 25).

Hydrogen also needs off-takers and Cumbria’s hydrogen strategy should include key "anchor" off-takers such as Sellafield, Innovia Films, BAE and the NHS et al, who are high emitters and are key holders of purchasing power, assets and employment locally. Green hydrogen facilities will also be able to complement the process of decarbonization and electrification in other hard to abate sectors such as lime and cement, heavy road transport, as well as have Carbon Capture and Storage (CCS) in Morecambe Bay and nuclear co-generation.

Another potential off-taker, if the land is suitable for modern steel manufacturing, could be to develop a green steel manufacturing plant in Workington or its surrounds. Workington is where Henry Bessemer introduced a new steel manufacturing process (the Bessemer process) which became the most important technique for making steel in the nineteenth century.

Beyond Cumbria, it is important to integrate with the North West’s low-carbon industrial cluster plan by 2030 and consider additional “anchor” investment projects such as HyNet North West’s (‘HyNet’) hydrogen and carbon capture utilisation and storage (CCUS) infrastructure.

The North West boasts the largest concentration of advanced manufacturing and chemical producers in the UK and according to Net Zero North West, industrial consumers in the region emit nearly 17 million tonnes of carbon emission per year.

Substantial Historical Emissions

Thinking more about the coal's end-use emissions of 9 million tonnes of C02e each year. This is as much as a country emits, in fact, it’s the same as Papua New Guinea emitted in 2016 and is a significant number of additional emissions every year and cumulatively until 2049, and after.

Then consider cumulatively the mine's operational emissions of 0.4Mt CO2e per year (9.6MT for 24 years) which will add to the area's substantial historical emission debt. At a guess, the area's coal and steel emissions from days gone by - easily equal a high emitting country.

Methane is also an issue. While WCM will use a series of methane capture and elimination methods to reduce the mine's methane emissions - the mine will cause 25 years of methane emissions to the atmosphere, initially entirely unmitigated and then there will be residual emissions as the methane capture system cannot capture 100% of the methane.

Further afield than Woodhouse Colliery itself, there is also the real and present danger of methane leakage from other abandoned mines in the area. Mines in Cumbria were known to be ‘gassy’ and their high concentration of methane has killed hundreds of miners. One example is the Wellington Pit disaster when 147 people died from a methane explosion.

Copeland's Carbon Budget

The Tyndall Centre has produced a report setting out science-based carbon budgets for Copeland based on translating the “well below 2°C and pursuing 1.5°C” global temperature target into a national UK carbon budget. The report makes three key recommendations for Copeland: 1. Stay within a maximum cumulative carbon dioxide emissions budget of 3.1 million tonnes (MtCO2) for the period of 2018 to 2100. 2. Initiate an immediate programme of CO2 mitigation to deliver cuts in emissions averaging a minimum of -12.4% per year 3. Reach zero or near zero carbon no later than 2043.

Based on these numbers, it is worth mentioning that Woodhouse Colliery's operational emissions alone would eat up Copeland's carbon budget in 7.75 years.

Listen to Copeland's People's Panel on Climate Change Recommendations

In 2021, Copeland Council, Cumbria Action for Sustainability (CAfS) and other local organisations supported a Copeland People’s Panel on Climate Change, which met ten times with thirty residents taking part. One key recommendation was that Copeland should become a centre for excellence for green jobs, skills, and training for both young people and adults. They also suggested a sustainable energy training hub and significant investment in renewable energy for Copeland including community ownership of energy generation wherever possible. All of these projects should also invest in local skills development and contribute to a community benefit fund.

Within the borough, there are 'Two Copelands’ – the ‘haves and have nots’. High salaries for Sellafield workers, next to those with poorer standards of health and education, low incomes and benefits-dependency in pockets of deprivation. Copeland itself needs levelling up and it has perhaps more potential to prosper from net zero than many other parts of the UK, given its wealth of green assets.

Opportunities abound and they are there for the taking. Equally important is including the community to help shape a better route to economic prosperity. One that is anchored by industries of the future, rather than those of the past.

End Notes

[Please note that Whitehaven is near where the mine will go. Whitehaven is currently a ward of Copeland Borough Council and is more broadly described in this blog as West Cumbria. Copeland will soon become part of Cumberland (as of April 2023). And just to add to any confusion - all of Cumbria used to be called Cumberland from the 12th century until 1974. Interestingly, the names 'Cumberland' and 'Cumbria' derive from 'kombroges' in Common Brittonic, which originally meant "compatriots".]

[i] https://cumbria.gov.uk/elibrary/Content/Internet/538/28159/4444517923.pdf - page 22

[ii] Source: https://www.endsreport.com/article/1708768/case-cumbrian-mine-lies-tatters-questions-surface-sulphur-content-coal

[iii] Source: https://www.theccc.org.uk/publication/letter-deep-coal-mining-in-the-uk/

[iv] Source: www.westcumbriamining.com/wp-content/uploads/WCM-Statement-15th-March-2021.pdf

[v] Source: https://exbulletin.com/world/international/1580314/

[vi] Source: https://www.theguardian.com/business/2022/may/01/steel-boss-dismisses-claim-that-sector-needs-new-cumbrian-coalmine

[vii] https://www.rebeccawillis.co.uk/wp-content/uploads/2021/02/letter-to-PM-from-academic-experts-re-Cumbria-mine.pdf

[viii] Source: https://www.carbonindependent.org/33.html